Brexit dumps huge Oz wine exports to UK in utter chaos - winemakers seem surprised

by PHILIPWHITE

Jeez. Everyone's shocked.

But over the weekend, Marc Soccio of the wine and agriculture industry finance

house, Rabobank, worked out a statement. He thought a lower pound

would send whatever was left of the United Kingdom out looking for suppliers of

cheaper meat and wine.

Brexit dumps huge Oz wine exports to UK in utter chaos - winemakers seem surprised

by PHILIPWHITE

Jeez. Everyone's shocked.

But over the weekend, Marc Soccio of the wine and agriculture industry finance

house, Rabobank, worked out a statement. He thought a lower pound

would send whatever was left of the United Kingdom out looking for suppliers of

cheaper meat and wine.

"All of a sudden

those products start to look a hell of a lot more expensive and there would be

a demand impact from that if it lasts long enough ... We all expected if they

did choose to leave the EU that the pound would be negatively impacted and the

pound will be lower for longer as a consequence and it means the value of our

key agri exports will be impacted," he told The Weekly Times.

Duh. While this came as

not much of a shock to some, it coincided with whispers from a growing number

of small wine producers. "Well Whitey," is the mantra, "that

sure explains why my Brit agent hasn't called back to confirm that order they

placed a month back."

Put simply, as far as the

ethanol business goes, Brexit looked like it could bring a good-sized drop in whisky

prices - it there's any good whisky left in the mountains of barrel stacks in

Scotland - and an expectation that if we are to hold our tenuous acres of the UK

discount shelves, our wine would have be considerably cheaper.

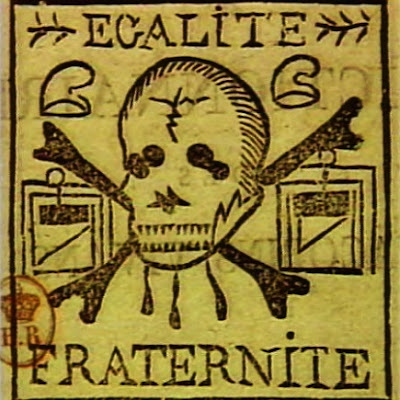

Of course there's nothing

new in this line. They've been throwing that at their prison-camp/colony for

two hundred years, Land of Hope and Glory

playing while the churchbells chime.

.

But it's still not quite

what the entire communities of technically bankrupt growers along our big

rivers hoped to hear.

Soccio's explanation of

the shenanigans in Britain and the EU were remarkable only in their solitude:

if anybody else had anything to say in consolation or warning they certainly

didn't manage to raise their bleat above all that shocked-and-disgusted white

noise that filled the media.

Not to use my name too

lightly.

There'd been little in the

way of sage advice from big exporters who you'd think probably understood the

implications of the British mischief, like Pernod Ricard (Jacob's Creek) or

Accolade (Hardy's).

Or for that matter, all those confounding wine industry

councils - bodies may be the better

word for them - seemed just as shocked and bedazzled by Brexit as the half of

Great Britain that voted against it.

So while we wait for a

better explanation, let's go back a bit.

First, the Brexit

referendum was predictable.

Second, its results are

not compulsory: government can ignore the people's will if it chooses. That

referendum was really not much more than a very extravagent market research

poll like our promised equal marriage rights plebiscite. Politicians can ignore

its result.

Third, It always pays to

read the treaty: the formal mechanics of a UK secession from the EU cannot

commence until the Prime Minister of the United Kingdom signs the Lisbon

Treaty's Article 50. This will not be happening soon.

Whether he meant to or

not, David Cameron has left his successor to fry as the lobbyists for

everything stable in finance, banking, politics, international economics and

the EU itself mount impossible pressure on whoever ends up being PM, probably

Boris Johnson, to do something else. Anything else.

Of course a person as

stable and predictable in their conservatism as BoJo can be expected to do pretty

much exactly that. Whatever it is. In the meantime, it's astonishing to hear

hardened Brit political hacks marvelling that Nicola Sturgeon is the only

leader in the British Isles with a plan. Those whisky prices may hold.

Fourth, in this world, all

the money flows to where it's easiest for it to be. So in the long term, like

the real long term, if Brexit really does become an exit and the burghers of

The City are smart, they can by deregulation make London an easier place to

traffic, and an alternative to the anal retention across the Channel. The

finance world will follow.

Even the finance world

drinks wine. They'll be very thirsty after this fiasco.

Which may be what Mr

Soccio meant by his "flight to safety: ... I think a lot of commodity

markets are going to be really shaken by this result until we can fully digest

it," he said. "The same goes for currency. These sorts of currency

shifts are going to take a while for commodity markets and financial and

general equity markets to recalibrate."

So. It's a matter of wait

and see. As I suggested earlier. Duh.

In the meantime, the

exporters of Australia's biggest discount wines to the traditional United

Kingdom market are in very deep trouble. Whether they can continue to screw our

embattled growers by convincing them to stay in their current unprofitable horror remains to be seen.

Cruelly, Brexit may simply

finally force the closure of a huge part of the big irrigation, high-volume,

minimal-profit market, when no amount of political wrangling over water and global

warming and whatnot will ever achieve the same harsh result.

No federal politician has

been game to face this.

As for that premium end

where the profits reside? Those little strugglers with the unconfirmed orders?

Right now, they're not

much better off.

So what has our Prime

Minister got to say about all this, with an election staring us down?

"I remind Australians

that, given that we are living in a world of great opportunities, but also

great challenges and uncertainties, now more than ever Australia needs a stable

majority Coalition government," he said.

I reckon that's worth another

"Duh!"

No comments:

Post a Comment