Just one angle on the slippery WET and its rebate vs excise:

this thing's got a long way to go

by PHILIP WHITE

While I don't usually even consider putting explanatory

flashes like this at the top, I'm entering the territory where the shockjock

introduces me by saying "We've got this wine bloke on the line from

Adelaide, like a wine writer, probly gets all his wine for free, who wants everybody

to start paying a lot more for their glass of wine by the telly with their tea

... " Please let me know if I've got this line of observation wrong. I'd like to see good wine get cheaper!

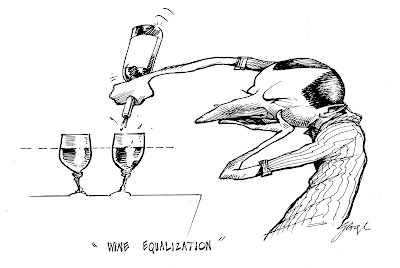

WET? WET? Lotsa clucking

and fretting about the Wine Equalisation Tax (WET) this last week, and

climbing.

From its conception, the WET

was negotiated with more than a levy in mind. It was also a levee bank to ease

the movement of a giant wine lake from the Murray Darling Basin. In an age of

obscene management by testosterone, the wine industry councils and some politicians

oversaw such feverish vineyard expansion they flooded the old inland sea with a

swillion olympic swimming pools of highly-irrigated plonk which somebody would

have to drink.

The 2000 introduction of

the Goods and Services Tax (GST) saw a 41% wholesale sales tax on wine eventually

chopped to 29% upon which the new 10% GST would be added at retail. Winemakers

were irate: they thought the GST would bring the total elimination of this sales

tax, but ended up paying the 29% anyway.

Government's cheek in

breaking its promise and insisting on this impost, then calling it an

Equalisation Tax is to this day a perfect indicator of the derision politicians

generally show wine industry councils.

The tax wasn't equalising

anything at all.

Always the prima donna of

the ethanol peddlers, Australian winemakers had insisted on paying tax

differently to other boozemongers. Beer and spirits makers, and all the

premixed kiddylikkers and gins and Jacks and Jims and Bundy's and whatnot pay

excise, which is a flat tax upon the amount of pure ethanol in your drink.

Stronger your drink, more

excise you pay. GST goes on top.

Pretty sensible way of

taxing a dangerous depressant, you'd think.

But not our winemakers.

Having somehow convinced the powers that be that their ethanol is morally

superior to other ethanol, the winemakers pay no excise. Instead, they have their

WET, which even at 29% ensures that cheap refinery plonk of dismal quality is taxed

at a lower rate than good clean premium wine, regardless of its alcoholic

strength.

Cheaper the plonk, lower

the tax rate.

You wanta be taxed at a

higher rate? Add value to your product. Give it true worth. Do it responsibly. Pay

properly for your grapes. Look after the country and do things really carefully

with no detrimental cost to the ecology or the waterways or public health.

Right from the start, aim to make a nice clean profit, true blue, as soon as

you can. Employ a few people in the vineyard and winery. Train them.

Sell your ethanol

dissolved in a more wholesome, gastronomically intelligent, healthy natural matrix

called premium wine. More beautiful, more luxurious; not so goddam cheap and nasty.

Therefore more expensive. For

your trouble, the WET system will ensure you are taxed at a higher rate,

ensuring your wine costs even more. Bung the GST on the top and the gap between

your price and goonbag juice just grows and grows.

Regardless of whether any

of the growers make a cent the politicians along all those big rivers can keep

their seats by keeping right on swapping more irrigation water we don't have

for cheaper and cheaper wine for the poor and the elderly and the

differently-abled and the differently-coloured and everybody can guzzle on at

will or whim and she'll be right mate.

But she wasn't. By 2004 it

was apparent that too many smaller producers were in deep trouble, so a scheme

was introduced wherein the winemaker can claim a rebate of 29% of the wholesale

tax paid on domestic sales. This capped out at $290,000 upon introduction, but

within a couple of years winemakers had convinced the treasurer to wind it up

to $500,000 maximum per financial year.

In the

recent budget, Prime Minister Turnbull's conservative coalition announced it

would be chopping this to $350,000 by July 1, 2017, and further to $290,000 in

2018.

You can imagine the

regular recipients of these moneys feeling hurt by Turnbull's parsimony, but

that's not all they're whingeing about. What's really got 'em whining is the

plan to tighten up the general rules of the system to eliminate some of the

obscenely overt rorting which some of us have complained about for decades.

The regulations are also tightening

to eliminate the New Zealanders, who through free trade agreements can claim

the rebate if they sell wine in Australia, and local sharks who neither own nor

lease vineyards nor wineries yet live off the rebate through nefarious bulk,

unbranded wheelings and dealings.

These 'virtual wineries' are

direct threats and rivals to the small premium producers they told us the WET

rebate was set up to assist.

In The Wine Front blog on 13 May, the highly-respected wine editor and

author Campbell Mattinson echoed the alarm of many when he wrote "More alarmingly – and

tellingly – the proposed changes include an 'eligibility clause which

states that to qualify for the WET rebate you need to have a physical winery or

a substantial lease of a winery.' The general view is that the latter change

shows a fundamental misunderstanding of the way the Australian wine industry

works."

Perhaps not. Perhaps it indicates a forensic understanding of how indeed

it does work.

Mattinson then goes on to quote Master of Wine Andrew Caillard at some

length.

"The

idea of owning or leasing a winery to access the rebate, is anti competition,

anti small business, anti entrepreneurship, anti new entrants, pro

protectionism, and pro industry stagnation," the expat Brit says.

"By imposing this proposed change it will stop or hinder grass

roots innovation and visions. I think it is an appalling and unnecessary

change. It is counterintuitive, passionless and utterly obtuse. There is no

sense of history or ambition."

Last time I looked, Caillard worked for Woolworths. In fact he has

worked for them since selling them Langton's, the powerful price-setting

premium wine auctioneer. Woolworths also

owns Dorrien Estate, one of the Barossa's biggest wineries and home to Cellarmasters,

amongst a myriad other brands.

This big refinery is crawling with winemakers who rent its facilities to

make their own "small" brands, using the WET rebate to pay their

bills.

It is also full of the sorts of wines, all looking like small family

businesses, that fill the main central discount floorspace of its own joints

like Dan Murphy's. These wines too are made by Woolworths at Dorrien. While

Woolworths sets up dozens of these 'independent' boutique-looking firms to sell

through its own liquor chains, one would hope that in its shareholders'

interests it claims the WET rebate on every brand that fits the government's

legal prerequisites.

This ain't over yet.

1 comment:

Thanks for writing this, we're more 'o' less on the same page. I'm not sure I understood the line about the small winemakers who rent out space at larger facilities. I've worked vintage at a few of these contract facilities and generally view them as a positive in the industry, and love making wines for small producers who can't afford their own facilities. Without a rebate they'll be in the same position as our small brewers, who can't bring a decent product to market (let's be honest) because they're paying the same tax rates as the big breweries.

Post a Comment