"And I will shew wonders in the heavens and in the earth, blood, and fire, and pillars of smoke. The sun shall be turned into darkness, and the moon into blood, before the great and the terrible day of the LORD." Joel 2:30-31

"And I will shew wonders in the heavens and in the earth, blood, and fire, and pillars of smoke. The sun shall be turned into darkness, and the moon into blood, before the great and the terrible day of the LORD." Joel 2:30-31Biggest rivals head to bed

For many, it was a great and/or terrible week. There’s been plenty of smouldering rage and dark feelings of war in the last days of Chateau Reynella, but that’s only what's happened on the face of the Earth. Recent big signs in the heavens have included the whole of Constellation itself becoming Accolade, which comes from the French accoler, which came in turn from the from the Vulgar Latin accollare, which means to squeeze the neck. (*1)

Another is this matter of the choker’s owner, the private equity outfit gaily known as CHAMP, formally getting into bed with its biggest Australian wine rival, Treasury Wine Estates. This is not just two humungous beefcake models lying back to read to each other, this is hardcore. In a classic act of Apollonian trajectorialism, they’re gonna squirt into each other’s containers!

“If I made wine from a vineyard I grew and loved, like I do at Marius, and I got it right, and I was proud of it,” my sage mate Pike asked as we wondered at these signs, “if it meant anything to me at all, what would the most critical thing be after growing it and making it?

“Bottling it myself!”

Small premium producers like Pike dream of affording the luxury of owning their own bottling line. Contract bottlers can, and do, wreak havoc in batches too small for them to properly notice, but just big enough to provide a meager income for blokes like Pike if the bottler can get it into the bottles unadulterated. Pike's wines are beautifully bottled, but it’s a fraught scene.

Woolworths owns Vinpac, by far the biggest contract bottler in the country. It sees and samples your wine long before you get it on the market. Any bright upper-echelon manager who didn't consider keeping an eye on this to steer Dan Murphy's purchases and the styles of wines Woolworths makes at their giant wineries in the Barossa should be hauled before the shareholders.

On the other hand, surrendering the precious juice of one's toil and soil to one’s foremost rival, or indeed outright enemy, for the final ritual of packaging and sealing seems nuts.

But that’s modern business for you. CHAMP’s Accolade exports more volume for less money than Treasury; Treasury exports lower volumes for more money than CHAMP’s Accolade. CHAMP owns the perfectly-named Accolade Park, a huge, fast, bottling and packaging factory in Bristol, UK, which could use some more work; since it now exports so much wine in bulk, Treasury’s bottling line at Wolf Blass in the Barossa could be busier, too.

So CHAMP shuts Chateau Reynella, as this writer has long maintained it would relentlessly do, and sends that wine to Treasury for bottling in the Barossa, in exchange for Treasury doing its UK bottling in Accolade Park in Bristol. As indeed Tony Keyes prophesied in his essential Key Report a month before they'd admit to it.

So CHAMP shuts Chateau Reynella, as this writer has long maintained it would relentlessly do, and sends that wine to Treasury for bottling in the Barossa, in exchange for Treasury doing its UK bottling in Accolade Park in Bristol. As indeed Tony Keyes prophesied in his essential Key Report a month before they'd admit to it. This announcement, along with the news that set the southern Vales smouldering - the bit about 175 people getting the flick - was made in a masterpiece of sophisticated manipulation of media, workmen and women, and message, which they said was necessary to avoid trouble at the Stock Exchange. Man, it was crisp!

But it leaves the local wine business reeling with wonderment and terror. If these two arch rivals can do their swapping of juices business in the name of heightened efficiency and economic rationalism, what other signs and wonders will they provide?

It was perhaps not quite a fluke that this news came the day before Caltex announced it would be closing its oil refinery. Australian drivers would be henceforth buying their fuel from foreign refiners, whose costs were lower. Just as oil refineries make raw oil sufficiently explosive and clean to be safely used in motor vehicles, so wine refineries clean and sanitise grape ethanol to make it safe enough for human consumption, with or without explosions.

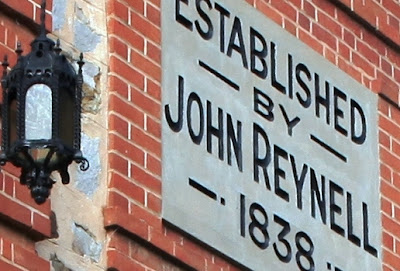

And that's somebody's oil refinery at the top by the way. Wineries look like this:

As CHAMP’s Accolade seems intent on leaving Reynella and indeed the historical Tintara winery in the main street of McLaren Vale, both sites ripe for the type of lucrative subdivision we saw fester on the site of John Reynell’s heritage vineyard, why wouldn’t they use up some spare capacity in Treasury’s arsenal of refineries to save a little more money? If thousands of little guys can get by without the inconvenience of owning your actual winery, why can't the big guys? There’s room at Treasury's Rosemount, for example, at McLaren Flat, to make heaps of wine for Accolade.

These huge companies already trade enormous amounts of bulk wine, or buy it from the same grey market traders. They don't like the cost of running wineries.

Increasing the business of CHAMP’s Accolade Park in Bristol obviously makes it a juicier morsel for sale, just as Treasury’s Wolf Blass bottling hall becomes more alluring. But showing the world that these two awkward giants can get along so nicely may well be presenting acquisitive companies like China’s scarily-named Bright Food with an even tastier titbit. This state-owned leviathan is busily buying into the Bordeaux trade; it is often cited as a likely buyer of Treasury.

Watching James Packer’s Treasury share trading is probably a good barometer.

Now that Treasury has appointed itself some flash new internationalist directors (*2), it will be even more signs and wonders, methinks, and that smoke billowing on the horizon could well be Accolade. To start with.

There’ll be more human casualties every time a bomb goes off.

It may suddenly seem sensible to have the bottom 80-90 per cent of Australia's wine made in one big factory, and then divvied up. It would be in the shareholders' interest.

As for moving your refining offshore to save your shareholders a few cents per litre, how long will it be before Jacobs Creek or Bright Foods or somebody starts exporting wine made in China into Australia?

Forgive me Lord for my impertinence. And praise Bacchus for showing me the light.

1. Pardon my stutter while I repeat my suggestion that big wine companies seem intent on branding themselves with the sorts of names you see on Korean cars. Which may go part of the way to explaining why they also share the same sort of resale values ... Accolade is a true-blue screamer, and a very good reason why experienced writers should be engaged when boozemongers enter the words business. I may be overestimating them, but apart from their ignorance of the necking implications, those responsible for Accolade may have been of such sophistry as to imagine their new name had subliminal implications of naughty alcohol and safe lemonade, not to mention the obvious inference of the clap. There already was a Honda called Applause, so I suppose they held back on that. What the hell was wrong with Hardy's Wines?

2. Non-executive director Paul Rayner will become Treasury chairman, replacing the outgoing Max Ould. As of September 1st., the three new non-executive directors will be Ed Chan, a former president and chief executive of Wal-Mart China, Garry Housell, director of several companies such as Qantas and Orica, and Michael Cheek, a former chairman of Finlandia Vodka Worldwide.

1 comment:

I used to be suggested this blog by way of my cousin. I’m not certain whether or not this submit is written by him as no one else recognise such targeted approximately my trouble. You’re amazing

Post a Comment